For years, Alberta was the envy of other Canadian provinces, enjoying one government surplus after another, with its vibrant resource sector generating a wealth of opportunity for businesses.

Those prosperous days are gone, at least for the foreseeable future.

Low oil and gas prices and a dark prognosis for energy businesses in general have triggered waves of layoffs and a surge in consumer bankruptcies. It’s created a ripple effect that is impacting almost every company and individual’s ability to repay debt.

How bad is it?

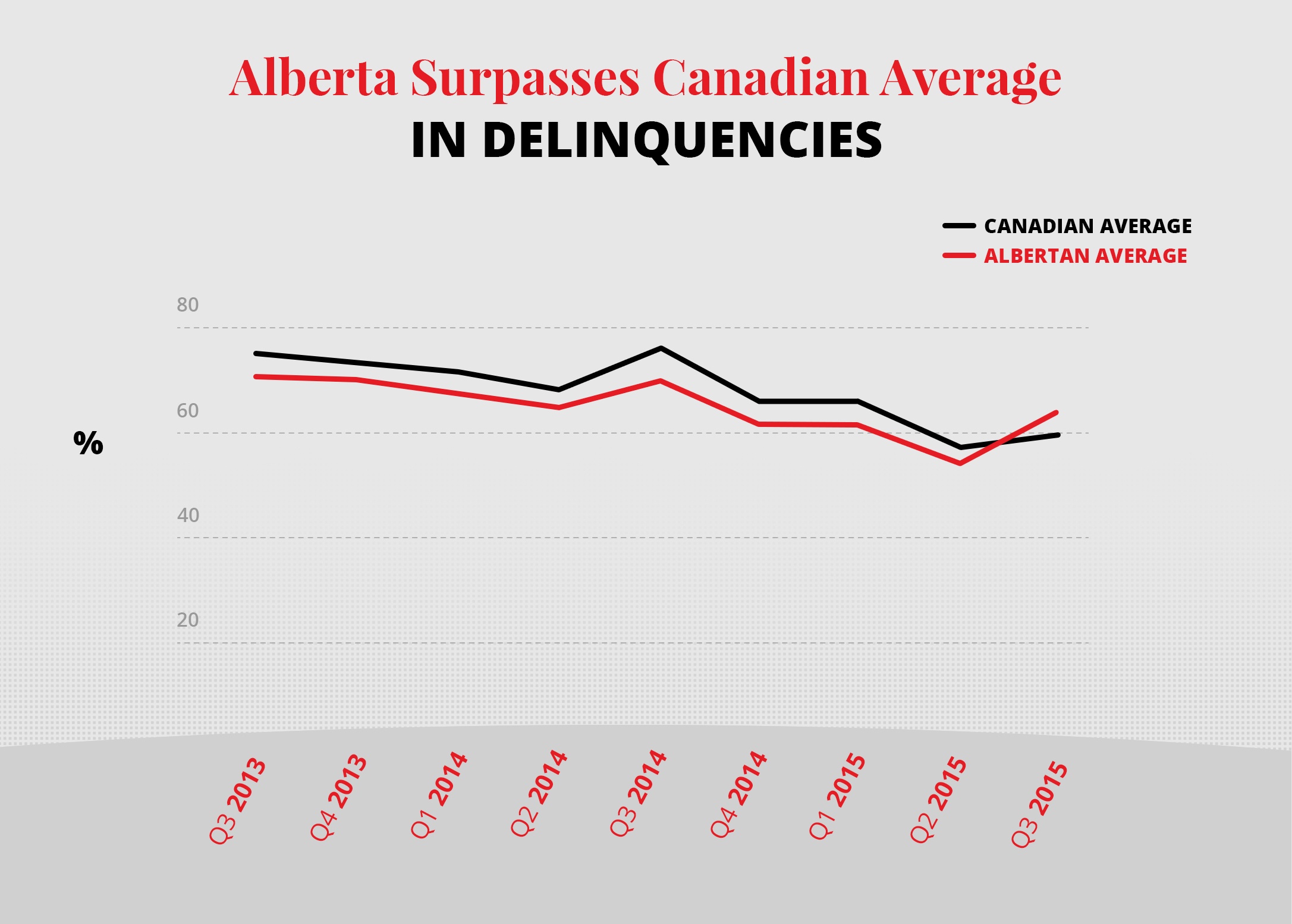

Have a look at the most recent data from Transunion:

It’s easy to see how the trend has rapidly changed in Alberta, from cruising comfortably below the national average in overdue debt payments to surging in delinquencies during the third quarter of 2015.

What this means to credit grantors with clientele in Alberta is that collecting debt is no longer easier but instead more difficult and riskier than elsewhere in the country. It’s a sudden reversal of fortunes.

According to Jason Wang, TransUnion’s director of research and industry analysis, Canadians in general have been managing debt quite well, but less so in Alberta.

“It doesn’t look like there’s a big difference, but you have to understand that historically Alberta has been better. Now Alberta has caught up and actually has exceeded the national average,” Mr. Wang says.

Government of Alberta bankruptcy statistics show that consumer bankruptcies are also on the rise, with a year-to-year increase of 15.2% as of August 2015, having risen in 7 out of 8 months since January.

As money becomes more scarce, the ripple effect can be expected to compound, especially in the commercial debt collection field, where the supply chain is especially vulnerable and smaller businesses have a dangerous tendency of operating hand-to-mouth. Lately whenever we call an Alberta business to collect debt, we are often told that the problem stems from a ballooning Accounts Receivable problem downstream. That is major cause for alarm.

It’s easy to visualize what might happen next: when debtors begin to go bankrupt, only the most proactive credit grantors will collect. The others will be left holding the bag, and risk suffering the same agonizing fate.

Don’t let it happen to you.

Even more importantly, do not wait for things to turn around. It almost certainly won’t happen soon enough for many businesses. According to virtually all economic forecasts, oil and gas activity in Alberta, as well as Saskatchewan, and Newfoundland and Labrador, is expected to remain weak, reflecting those provinces’ reliance on commodity producing industries. Even in good times, you can expect the collectability of debt to decline rapidly over time, and in a recession the trend can be expected to accelerate.

THE SOLUTION: ramp up your collection efforts and eliminate wiggle room, effective immediately. Turn over all delinquents to your debt collection agency without hesitation.

If debtors are unable to pay you today, expect the situation to get worse—not better. Be the first to collect, because those left behind will suffer. Talk to your debt collection professionals, and proceed aggressively.

As always, I’m here if you have any questions! All the best.

President and CEO of MetCredit, Canada's top-performing consumer and commercial collection agency

Go to LinkedIn